| political_geography_2019-2020__to_publish.ppt |

There are a total of 535 Members of Congress.

100 serve in the U.S. Senate.

435 serve in the U.S. House of Representatives.

How Laws are Made

Representatives sponsor a bill. The bill is then assigned to a committee for study. If released by the committee, the bill is put on a calendar to be voted on, debated or amended. If the bill passes by simple majority (218 of 435), the bill moves to the Senate. In the Senate, the bill is assigned to another committee and, if released, debated and voted on. Again, a simple majority (51 of 100) passes the bill. Finally, a conference committee made of House and Senate members works out any differences between the House and Senate versions of the bill. The resulting bill returns to the House and Senate for final approval. The Government Printing Office prints the revised bill in a process called enrolling. The President has 10 days to sign or veto the enrolled bill.

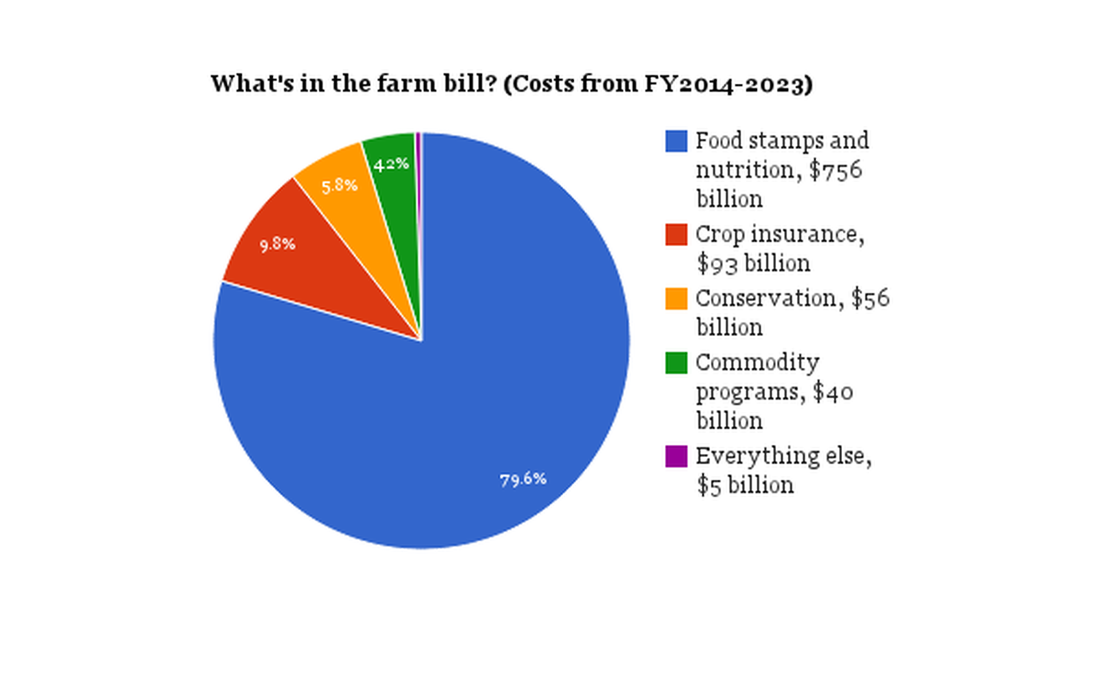

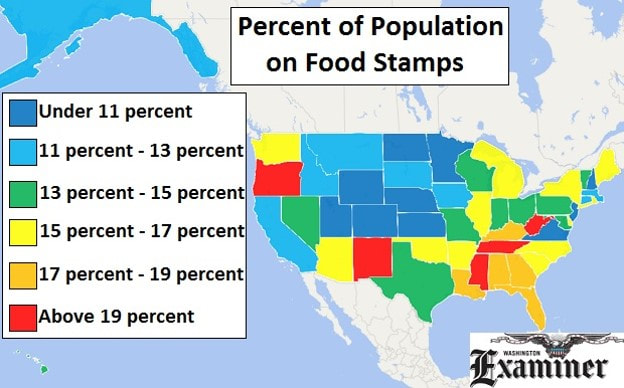

| Farm Act Bill 2021 In the United States, the farm bill is the primary agricultural and food policy tool of the federal government. The comprehensive omnibus bill is passed every 5 years or so by the United States Congress and deals with both agriculture and all other affairs under the purview of the United States Department of Agriculture. Beginning in 1933, farm bills have included titles on commodity programs, trade, rural development, farm credit, conservation, agricultural research, food and nutrition programs, marketing, etc. Farm bills can impact international trade, environmental conservation, food safety, and the well-being of rural communities. The agricultural subsidy programs mandated by the farm bills are the subject of intense debate both within the U.S. and internationally. The Agricultural Act of 2014 funds farm programs through 2018. The bill includes approximately $218 billion in annual spending for Department of Agriculture programs, around 80 percent of which is allocated for food stamps and other nutritional programs. It increased subsidies for biofuels. Approximately 62% of farmers receive no benefit from the FAB and 10% of farmers use 75% of the subsidies. However, food stamps and nutrition remained the largest portion of the bill's cost, amounting to a proposed $768.2 billion over ten years. Learn More about the Farm Bill Below | Trump's Proposed Auto/ Auto Parts Tariff Bill President Donald Trump has proposed a tariff bill that would apply to auto makers globally who import their automobiles into the American market. Countries most impacted by this would be China, Korea, Mexico and Germany. In essence the bill would place a special tax on vehicles entering the American market from foreign countries. The purpose of the bill is three fold 1) help fund the cost of a border wall between Mexico and the United States. 2) Help the American auto market and automobile worker and 3) punish what Trump calls "cheating" by those who do not engage in free trade. President Donald Trump has suggested that a plan for a wall along the Mexican border could be financed through a 20% border tax on all imports from Mexico, a new detail in the evolving saga between the U.S. and Mexico that would have a direct impact on the U.S. automotive industry. “It clearly provides the funding and does so in a way that the American taxpayer is wholly respected," White House press secretary Sean Spicer told reporters. “We are probably the only major country that doesn’t treat imports this way.” Trump's campaign promise to build a wall along the Mexican border and the president's desire to renegotiate the North American Free Trade Agreement by bringing automotive jobs back to the U.S. The tariff could cause auto buyers to purchase American made vehicles, the tariff would come at a cost Wall Street analysts estimate a tariff could raise the average prices of vehicles from Mexico by $2,300. Currently Mexico has become the seventh largest vehicle producer in the world. There are currently a number of manufacturers with a presence in Mexico, including GM, Fiat Chrysler, Ford, Nissan, Honda, Toyota, VW, Mazda and Kia. This manufacturing base produces 42 brands and 500 models in 22 manufacturing plants and has a network of 1,800 dealers, according to the U.S. Trade Representative. Germany, China and Korea also import billions of dollars annually into the United States Marchionne said most of the policies that President Donald Trump is proposing would benefit the automotive industry but warned that dismantling NAFTA could have "monumental consequences" for the industry. The U.S. trade deficit with Mexico was $49.2 billion in 2015, according to the U.S. Trade Representative. China and Germany have an even greater trade deficit. “Right now our country’s policy is to tax exports and let imports flow freely in, which is ridiculous," Spicer said. Spicer ran through the math by applying 20% to the difference, coming up with nearly $10 billion a year. The U.S. could "easily pay for the wall just through that mechanism alone. That’s really going to provide the funding,” he said. The border tax plan would need congressional approval, But the proposal could face resistance even among Republicans. "Border security yes, tariffs no," Sen. Lindsay Graham, R-S.C., wrote on Twitter. "Simply put, any policy proposal which drives up costs of Corona, tequila, or margaritas is a big-time bad idea. Mucho Sad." Learn More about the Trade Bill Below |

Posting Responses |

|